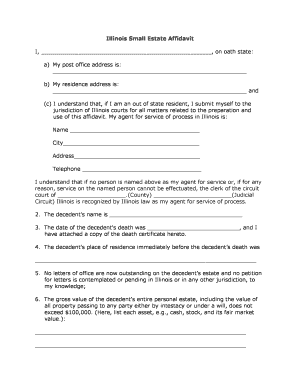

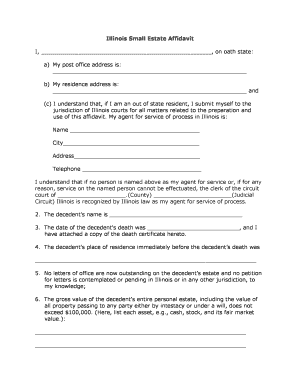

Information on the decedent’s funeral and burial expenses, surviving spouse/dependent award, and outstanding debts. Description and valuations of the decedent’s assets, including vehicle, make, model, VIN, and license plate number. The decedent’s name, date of death, and residence address before death. The name and contact info for an Illinois resident if you are not an Illinois resident who can serve as an agent for service of process in your absence. Your (affiant’s) name, address, phone number, and relationship to the decedent. You need to supply the following information in the small estate affidavit. What information do you need to file a small estate affidavit? Here, read more about the pros and cons of small estate affidavits and information on probate. The administrator will be legally empowered to collect and distribute the decedent’s property by presenting financial institutions and any other business or person who has the property with a copy of the small estate affidavit, a copy of the death certificate, and a certified copy of any existing will. The affidavit requires the administrator to swear in writing that all of these conditions are met and to set forth how the estate assets will be distributed. There are no disputes between heirs and beneficiaries.

The administrator contests no creditors’ claims.

The decedent’s assets amount to less than $100,000 and do not include real estate.Estate administrators can avoid opening a probate case and instead administer an estate without court oversight by using a Small Estate Affidavit if all of the following are true: A small estate affidavit is a form that the administrator of a deceased person’s (known as the “decedent”) estate can use to collect the decedent’s assets, pay their debts, and distribute the balance of the estate to the decedent’s heirs and beneficiaries.

0 kommentar(er)

0 kommentar(er)